Sub: Impact of the recommendations of 7th CPC- reg. Ref: AM(B) note No. 2015-B-265 dated 23/12/2015 addressed to GS/NFIR.With reference to the note received from AM(B) dated 23/12/2015 on the subject relating to the implementation of the recommendations of 7th CPC on Railways, the Federation at the outset conveys as follows:-

During discussions with the Hon’ble MR and the Board (CRB, FC, MS) on 23rd December 2015, the NFIR General Secretary has expressed that there is all-round unhappiness on 7th CPC recommendations as in many cases the ‘Take Home Pay’ is either very marginal or less than what is received by the employee now. The Federation also disputed the estimated financial implications (Rs.28,500 crores) and said that the estimated expenditure has been exaggerated. It was also brought to the notice of the MR the retrograde recommendations of 7th CPC, while the case of Railway employees of various categories was not dealt adequately and the Railway Ministry has unfortunately not apprised the inadequacies of Grades Pay and Pay Band of 6th CPC to the Chairman, 7th CPC.

2. As desired vide note dated 23/12/2015, the Federation furnishes the followins details as Annexures to this letter.

Yours faithfully,

sd/-

(Dr.M.Raghavaiah)

General Secretar

2. As desired vide note dated 23/12/2015, the Federation furnishes the followins details as Annexures to this letter.

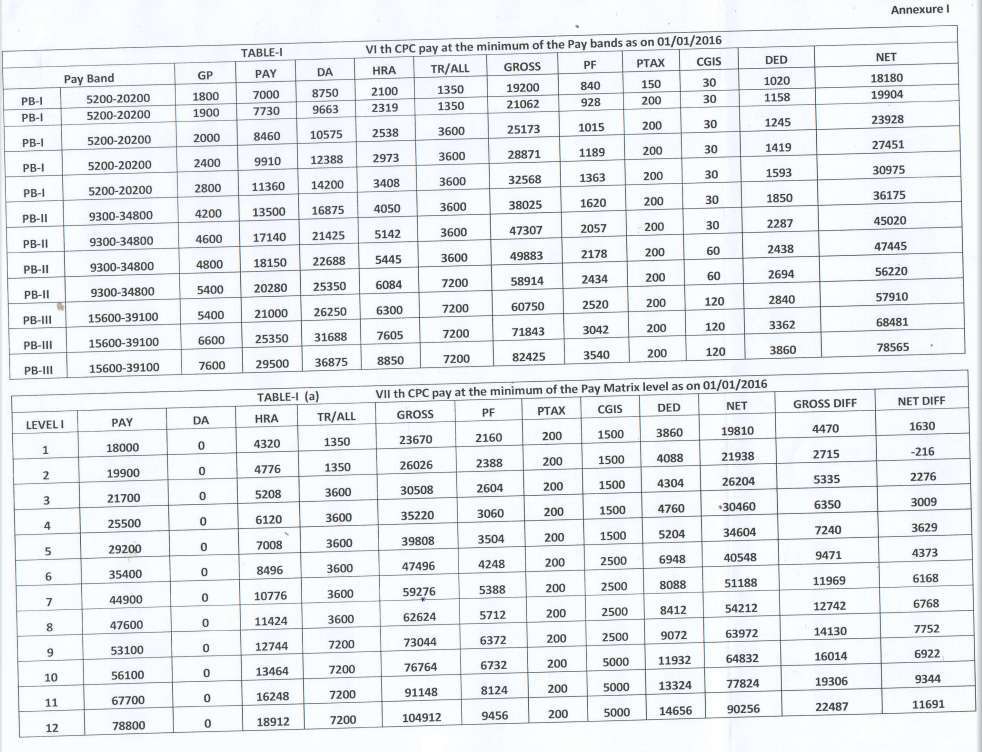

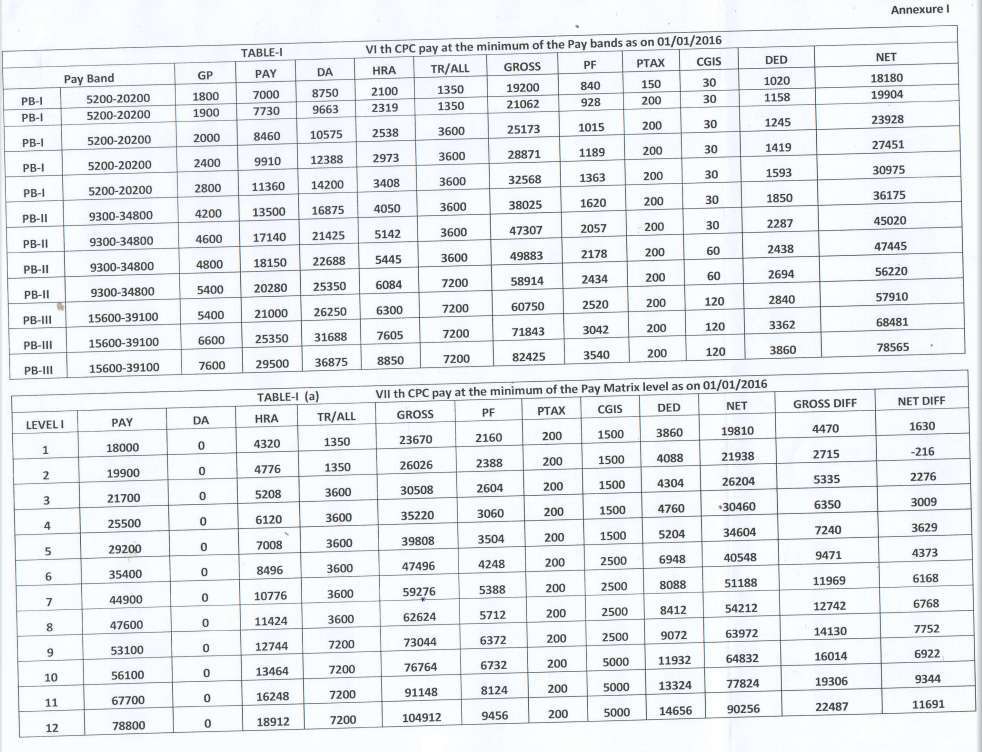

(a) Table -I gives the position of 6th CPC minimum pay in Pay Band & Grade pay (PB-1 to PB-3) as on 01/01/2016.

(b) Table -I (a) explains the 7th CPC minimum pay from Level-l to Level-12 of the Pay Matrix.

[A comparison of Table-I with Table-I(a)

reveals that the net benefit is marginal at Level-1, minus at Level-2.

However, there may be substantial increase from Level-7 and above. If

Income Tax deduction takes place, the increase will fall.]

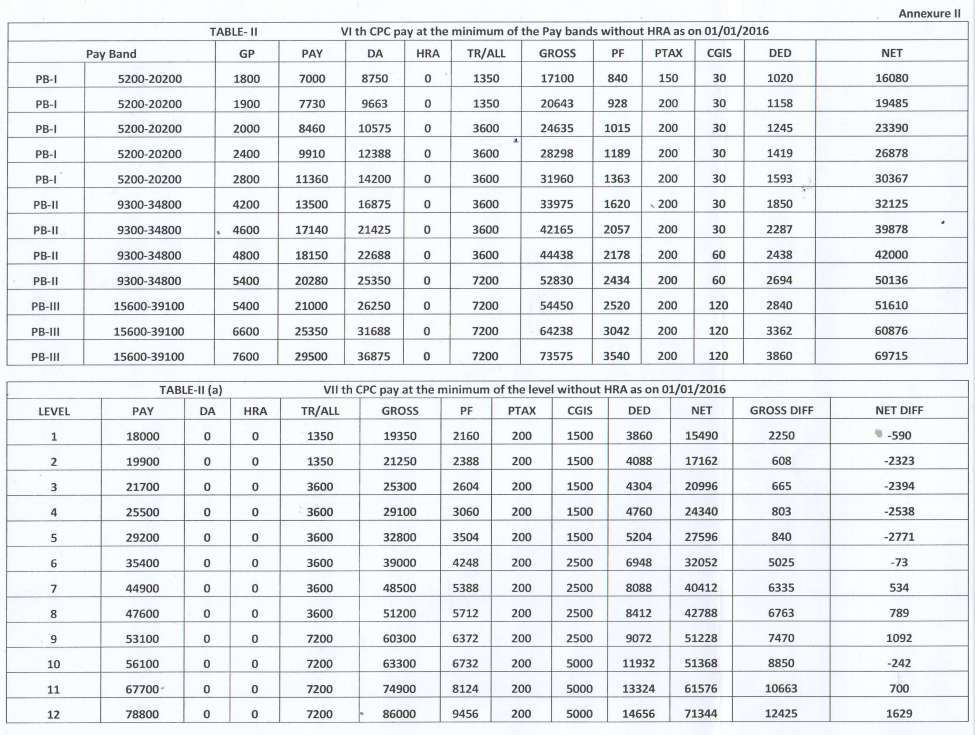

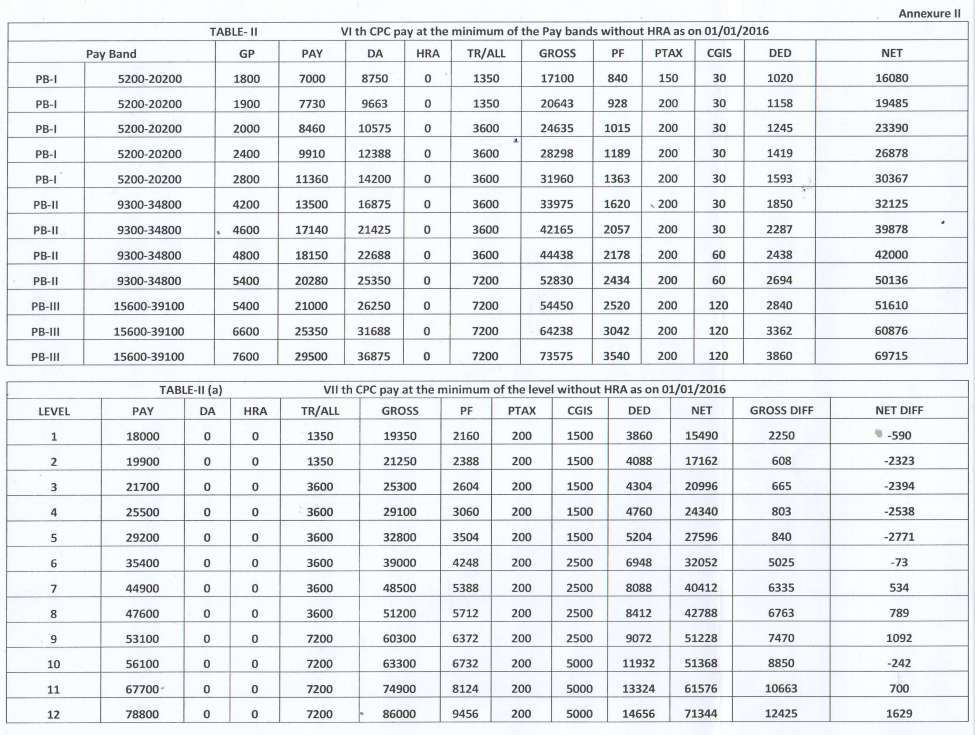

(c) Table-II indicates 6th CPC minimum pay in GP + Pay Band without HRA.

Table-II (a) gives 7th CPC minimum pay without HRA (staff in occupation of Railway quarters are not entitled for HRA).

[A comparison of Table-II with Table-II

(a) shows minus ‘Take Home Pay’ for employees of Level-I to Level-6 of

Pay Matrix and equally marginal increase to those in Level-7, 8 & 9

of pay Matrix. Again in Level-10 the ‘Take Home Pay’ will be less than

the present amount’. Overall position will be either “minus” or

“marginal increase”. The Income Tax deduction would further worsen.]

(d) Table-III shows the approximate 6th CPC pay of employees after drawal of 10 annual increments.

Table III(a) provides information pertaining to 7th CPC Pay (approx) for staff in Level-1 to Level-12 (Pay Matrix).

[A comparison between Table-III and

Table-III(a) reveals that there will be marginal increase to those in

Level-1 to Level-6. Although there will be an increase of more than 2400

to those in Level-7 to Level-12, the Income Tax deduction would reduce

their ‘Net Take Home Pay.’

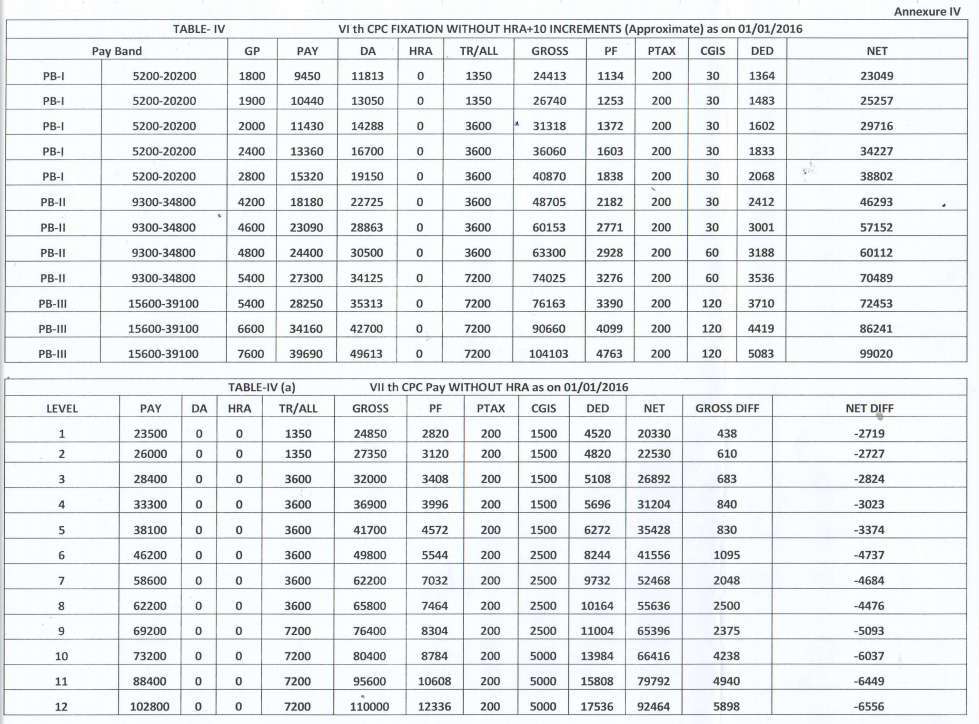

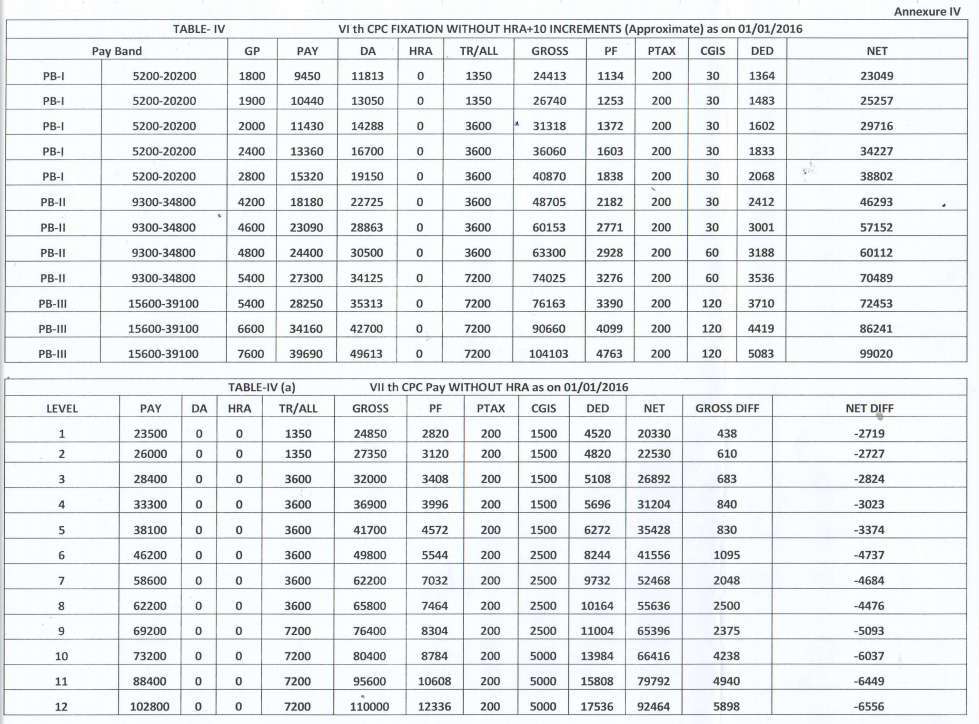

(e) Table-IV gives position of 6th CPC Pay of staff (without HRA + 10 annual increments – approx) as on 01/01/2016

Table-IV(a) explains 7th CPC Pay without HRA as on 01/01/2016.

[A comparison of Table-IV with Table-IV

(a) reveals that those in 7th CPC Pay Matrix Level-1 to Level-12 will

draw minus salary. With Income Tax deduction, the position may be more

worse.]

Note: (i) In the case of employees living in Railway Quarters (nearly 40%) the financial

(ii) The unfilled vacancies are

approximately over two lakhs since the last two years. The implications

of HRA will be Zero. The costs of these posts have already been saved by

the Indian Railways.

Encls: Annexure I to Annexure IVYours faithfully,

sd/-

(Dr.M.Raghavaiah)

General Secretar

(a) Table -I gives the position of 6th CPC minimum pay in Pay Band & Grade pay (PB-1 to PB-3) as on 01/01/2016.

(b) Table -I (a) explains the 7th CPC minimum pay from Level-l to Level-12 of the Pay Matrix.

[A comparison of Table-I with Table-I(a)

reveals that the net benefit is marginal at Level-1, minus at Level-2.

However, there may be substantial increase from Level-7 and above. If

Income Tax deduction takes place, the increase will fall.]

(c) Table-II indicates 6th CPC minimum pay in GP + Pay Band without HRA.

Table-II (a) gives 7th CPC minimum pay without HRA (staff in occupation of Railway quarters are not entitled for HRA).

[A comparison of Table-II with Table-II

(a) shows minus ‘Take Home Pay’ for employees of Level-I to Level-6 of

Pay Matrix and equally marginal increase to those in Level-7, 8 & 9

of pay Matrix. Again in Level-10 the ‘Take Home Pay’ will be less than

the present amount’. Overall position will be either “minus” or

“marginal increase”. The Income Tax deduction would further worsen.]

(d) Table-III shows the approximate 6th CPC pay of employees after drawal of 10 annual increments.

Table III(a) provides information pertaining to 7th CPC Pay (approx) for staff in Level-1 to Level-12 (Pay Matrix).

[A comparison between Table-III and

Table-III(a) reveals that there will be marginal increase to those in

Level-1 to Level-6. Although there will be an increase of more than 2400

to those in Level-7 to Level-12, the Income Tax deduction would reduce

their ‘Net Take Home Pay.’

(e) Table-IV gives position of 6th CPC Pay of staff (without HRA + 10 annual increments – approx) as on 01/01/2016

Table-IV(a) explains 7th CPC Pay without HRA as on 01/01/2016.

[A comparison of Table-IV with Table-IV

(a) reveals that those in 7th CPC Pay Matrix Level-1 to Level-12 will

draw minus salary. With Income Tax deduction, the position may be more

worse.]

Note: (i) In the case of employees living in Railway Quarters (nearly 40%) the financial

(ii) The unfilled vacancies are

approximately over two lakhs since the last two years. The implications

of HRA will be Zero. The costs of these posts have already been saved by

the Indian Railways.

Encls: Annexure I to Annexure IV

Yours faithfully,

sd/-

(Dr.M.Raghavaiah)

General Secretary

sd/-

(Dr.M.Raghavaiah)

General Secretary