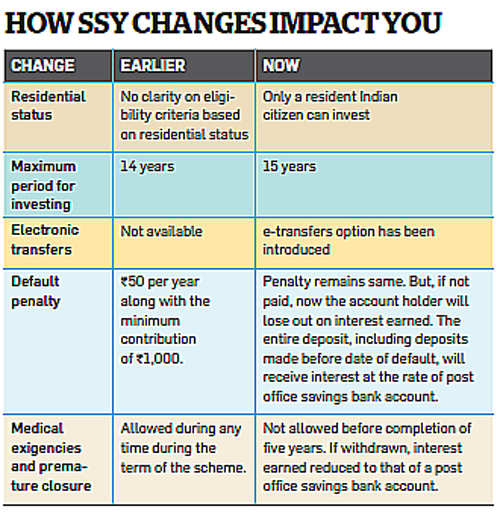

Non-resident Indians can no longer open a Sukanya Samriddhi Yojana (SSY) account. In fact, if your or your child's residential status changes to non-resident or she takes up another country's citizenship during the term of the scheme, no interest shall be paid from the date of citizenship or residential status changes and the account shall be considered closed.

A

girl child would be eligible for an SSY account only if she is a resident

Indian citizen when the account is opened, and remains so until maturity or

closure of account. This new rule was clarified by a notification issued in

March by the Finance Ministry.

As

per the new rules , a change in residential status has to be reported by the

parent/guardian within one month. In case the bank or post office is not

notified and an interest is credited to the account after the change of

resident status or citizenship, the earnings will be returned to the government

and the balance returned to the SSY account holder.

A

new clause has also been added for stricter penalties. Earlier, to regularise a

default, where the account holder did not deposit the minimum yearly

contribution of Rs 1,000/-, he was required to pay a penalty of Rs 50/- for each

year the condition was not met, along with the minimum contribution. Now, if

the penalty is not paid, the entire deposit, including deposits made before

date of default, will receive interest at post office savings bank account

rate—currently 4%.If excess interest has been paid, it will be reversed.

However, the long 15-year window to pay the penalty and make amends takes the

sting out of this new rule.

Further,

premature closures on grounds of medical exigencies, earlier allowed at any

time during the term of the scheme, has been restricted. Now, this cannot be

done unless the account has been functioning for at least five. If the holder

wishes to withdraw before completion of five years, his investment will

earn interest at the rate of a post office savings bank account.

The

investing term of the SSY scheme has also been increased from 14 to 15 years.

Also, now you can e-transfer your contributions.

Despite

all these changes, the scheme still earns 8.6% return— higher than old-time favourites

such as PPF, FD and recurring deposits. Plus, like PPF, SSY provides a tax

benefit under Section 80C. For the conservative investor, with a daughter below

10 years of age, it continues to be the best debt instrument in the market

today.

Source:-

The Economic Times