CIRCULAR NO : 01/2017

F.No.275/192/2016-IT(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

North Block, New Delhi

Dated the 2nd January, 2017

SUBJECT: INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2016-17 UNDER SECTION 192 OF THE INCOME-TAX ACT, 1961.

Reference

is invited to Circular No.20/2015 dated 02.12.2015 whereby the rates of

deduction of income-tax from the payment of income under the head

"Salaries" under Section 192 of the Income-tax Act, 1961 (hereinafter

‘the Act’), during the financial year 2015-16, were intimated. The

present Circular contains the rates of deduction of income-tax from the

payment of income chargeable under the head "Salaries" during the

financial year 2016-17 and explains certain related provisions of the

Act and Income-tax Rules, 1962 (hereinafter the Rules). The relevant

Acts, Rules, Forms and Notifications are available at the website of the

Income Tax Department- www.incometaxindia.gov.in.

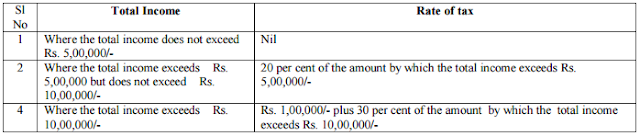

2. RATES OF INCOME-TAX AS PER FINANCE ACT, 2016:

As

per the Finance Act, 2016, income-tax is required to be deducted under

Section 192 of the Act from income chargeable under the head "Salaries"

for the financial year 2016-17 (i.e. Assessment Year 2017-18) at the

following rates:

2.1 Rates of tax

A. Normal Rates of tax:

B.

Rates of tax for every individual, resident in India, who is of the age

of sixty years or more but less than eighty years at any time during

the financial year:

C.

In case of every individual being a resident in India, who is of the

age of eighty years or more at any time during the financial year: